The allure of digital gold, the siren song of decentralized finance – cryptocurrency mining in the UK has moved beyond a niche hobby and become a serious investment avenue. But navigating the complexities of hashing algorithms, electricity costs, and regulatory landscapes requires a strategy. Whether you’re a wide-eyed beginner or a seasoned investor looking to refine your approach, understanding the nuances of crypto mining is paramount.

The foundation of any successful mining operation lies in selecting the right hardware. For Bitcoin (BTC), Application-Specific Integrated Circuits (ASICs) reign supreme, offering unparalleled hashing power compared to their energy consumption. Ethereum (ETH), though transitioning to a Proof-of-Stake model, still presents opportunities with GPU mining for other cryptocurrencies. For Dogecoin (DOGE), often mined in conjunction with Litecoin, specialized ASIC miners are also available, though GPU mining remains a viable entry point. Your hardware choice will dictate not only your potential earnings but also your operational costs and environmental impact – a crucial consideration in today’s socially conscious investment climate.

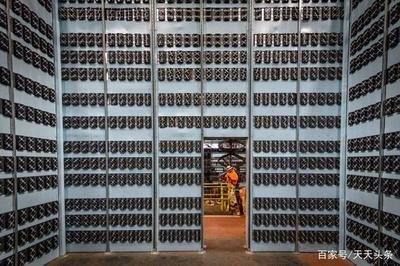

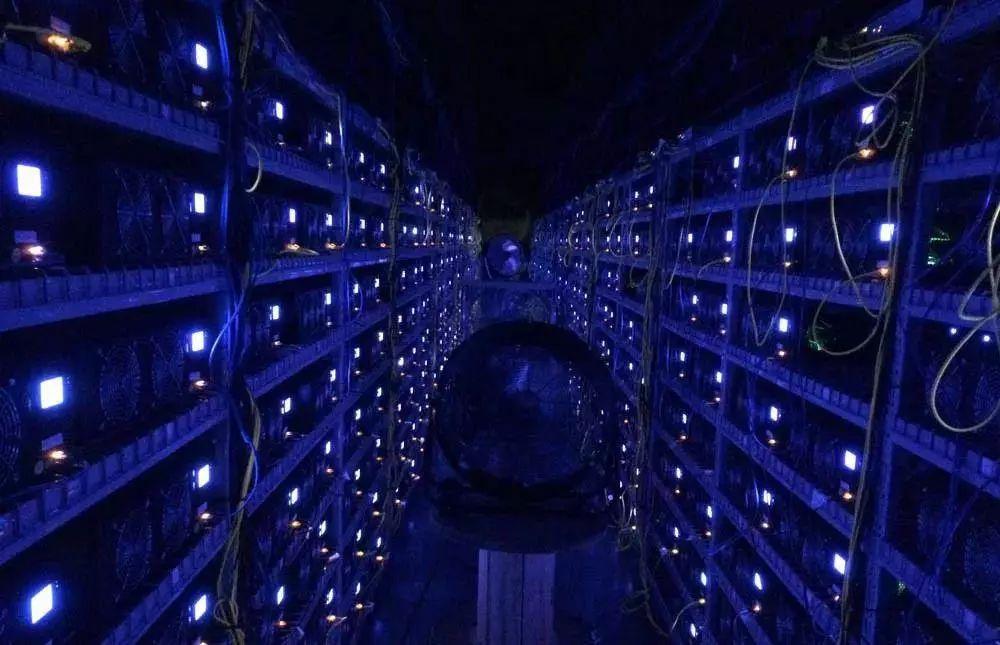

Beyond the hardware, location is king. The UK’s diverse climate and varying electricity prices necessitate careful site selection. Areas with cooler temperatures can reduce cooling costs, while regions with access to renewable energy sources can enhance your sustainability credentials and potentially lower operational expenses. This is where the concept of a mining farm comes into play. These purpose-built facilities offer economies of scale, optimized cooling systems, and often, more favorable electricity rates. Choosing between a DIY setup and hosting your equipment in a dedicated mining farm is a critical decision that impacts both upfront costs and ongoing management requirements.

Speaking of hosting, this option provides a hands-off approach to crypto mining. You purchase the mining hardware (the mining rig), and the hosting provider takes care of everything else – from installation and maintenance to power management and network connectivity. This can be particularly appealing for beginners who lack the technical expertise or the time to manage their own mining operation. However, it’s essential to carefully vet potential hosting providers, scrutinizing their reputation, security measures, and fee structure. Remember, you’re entrusting them with valuable equipment and a significant portion of your potential earnings.

A crucial aspect often overlooked is the regulatory environment. While the UK has generally adopted a relatively progressive stance toward cryptocurrencies, the legal landscape is constantly evolving. Staying abreast of the latest regulations related to crypto mining, taxation, and data privacy is vital to ensure compliance and avoid potential legal pitfalls. Engaging with legal and financial advisors specializing in the crypto space can provide invaluable guidance and protect your investment.

Risk management is another pillar of a robust crypto mining investment strategy. The volatility of cryptocurrency prices can significantly impact profitability. Implementing hedging strategies, diversifying your cryptocurrency portfolio, and regularly monitoring market trends are essential to mitigate risk. Furthermore, protecting your mining hardware from theft, damage, and cyberattacks is paramount. Implementing robust security measures, such as physical security controls, firewalls, and intrusion detection systems, is crucial to safeguard your investment.

For the aspiring pro, optimizing energy efficiency is paramount. Exploring innovative cooling solutions, such as immersion cooling, and leveraging smart power management systems can significantly reduce electricity consumption and boost profitability. Furthermore, participating in mining pools can increase your chances of earning rewards by pooling computational resources with other miners. However, it’s important to carefully evaluate different mining pools, considering their fees, reward distribution methods, and reputation.

Ultimately, success in crypto mining requires a blend of technical expertise, financial acumen, and a proactive approach to risk management. Whether you choose to embark on a solo mining venture or partner with a hosting provider, a well-defined strategy, continuous learning, and a keen eye on market dynamics are essential to navigating the complexities of this dynamic and rewarding investment landscape.

The rewards from different coins mined can be exchanged on various exchanges around the world. Each exchange has its own risk ratings, transaction fees, and support for the number of coins. Therefore, when you trade cryptocurrencies, you should select exchanges with good credibility and high security.

Beyond the technical and financial aspects, a successful crypto mining venture requires a commitment to sustainability. As environmental concerns intensify, embracing eco-friendly mining practices is not only ethically responsible but also increasingly vital for long-term viability. Investing in renewable energy sources, optimizing energy efficiency, and participating in carbon offset programs can help reduce your environmental footprint and enhance your reputation as a responsible crypto miner. This can also attract environmentally conscious investors and contribute to the overall sustainability of the cryptocurrency ecosystem. The journey from beginner to pro in UK crypto mining is a marathon, not a sprint. With careful planning, diligent execution, and a constant thirst for knowledge, you can unlock the potential of this exciting and evolving investment opportunity.

Leave a Reply