The quest for the best Bitcoin mining hardware in Europe for 2024 is a journey into a landscape constantly reshaped by technological advancements, energy efficiency considerations, and the ever-fluctuating price of Bitcoin. It’s a high-stakes game where optimizing hash rate and minimizing electricity consumption are paramount for profitability. Think of it as Formula 1 for digital finance, where the cutting edge separates winners from also-rans.

Navigating this complex terrain requires understanding not only the raw specifications of different mining rigs, but also the strategic implications of choosing the right hosting provider. European providers, in particular, offer a unique blend of stable infrastructure, stringent regulatory environments, and access to potentially cheaper renewable energy sources. This can translate to a significant competitive advantage in the long run.

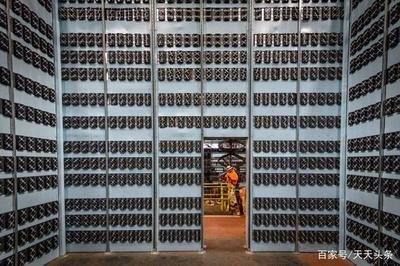

Choosing the right hardware is just one piece of the puzzle. Many miners, both seasoned professionals and newcomers, opt for mining rig hosting to alleviate the burdens of managing hardware, ensuring consistent uptime, and mitigating the impact of noise and heat. Hosting facilities typically offer specialized infrastructure, robust cooling systems, and reliable internet connectivity, crucial for maximizing mining efficiency. The geographical location of these facilities is also a key factor, influencing energy costs and regulatory considerations. Consider this – a mining rig in Iceland, leveraging geothermal energy, might be significantly more profitable than one running in a region with high electricity prices.

Beyond Bitcoin, the world of cryptocurrency mining extends to other proof-of-work coins like Dogecoin and Ethereum Classic. While Ethereum itself has transitioned to a proof-of-stake consensus mechanism, the legacy of its mining days continues to influence the market. Different cryptocurrencies necessitate different mining algorithms, requiring specialized hardware optimized for those specific algorithms. ASICs (Application-Specific Integrated Circuits) are dominant in Bitcoin mining due to their unparalleled hash rate efficiency for the SHA-256 algorithm. However, for other coins, GPUs (Graphics Processing Units) or even specialized ASICs designed for alternative algorithms might be more effective.

The volatility of the cryptocurrency market adds another layer of complexity. The profitability of mining is directly tied to the price of the mined cryptocurrency. A sudden price drop can render even the most efficient mining operation unprofitable, highlighting the importance of risk management and diversification. Miners often explore strategies like hedging their Bitcoin holdings or mining multiple cryptocurrencies to mitigate these risks.

Exchanges play a crucial role in the mining ecosystem, providing miners with a platform to convert their mined cryptocurrencies into fiat currency or other digital assets. The choice of exchange is important, considering factors like trading volume, security measures, and transaction fees. Liquidity is key, ensuring that miners can quickly and efficiently sell their holdings without significantly impacting the price.

Looking ahead to 2024, the landscape of Bitcoin mining in Europe will likely be shaped by increasing regulatory scrutiny and a growing emphasis on sustainable mining practices. Governments are increasingly concerned about the environmental impact of Bitcoin mining, particularly its energy consumption. This is driving demand for more energy-efficient hardware and a shift towards renewable energy sources. European providers who prioritize sustainability and comply with environmental regulations will likely gain a significant competitive advantage.

The competition among mining hardware manufacturers is fierce, driving innovation and pushing the boundaries of performance. New generations of ASICs are constantly being released, offering improved hash rates and reduced power consumption. Miners must carefully evaluate the cost-benefit ratio of upgrading their hardware, considering the initial investment, operating costs, and potential return on investment.

Ultimately, the “best” Bitcoin mining hardware and hosting provider for 2024 is a highly individualized choice, dependent on factors such as budget, risk tolerance, and long-term strategic goals. Due diligence is paramount – thoroughly researching different hardware options, comparing hosting provider offerings, and staying abreast of the latest industry trends are crucial for success in this dynamic and ever-evolving landscape. Consider the long game; focus not just on immediate profitability, but also on building a sustainable and resilient mining operation that can weather the inevitable storms of the cryptocurrency market.

Furthermore, the accessibility and availability of specific hardware models within Europe can vary significantly. Supply chain disruptions and geopolitical factors can impact the lead times and pricing of mining rigs. Building strong relationships with reputable suppliers and diversifying procurement channels can help mitigate these risks. The global chip shortage has already impacted the industry significantly, and its long-term effects are still being felt.

Leave a Reply to youTUBElegend Cancel reply