The siren song of Bitcoin mining continues to beckon, drawing in those eager to grasp a piece of the digital gold rush. But the landscape has shifted. Gone are the days of casually mining on your desktop. Today, profitable Bitcoin mining hinges on a delicate dance between cutting-edge hardware and astute energy management. It’s a complex equation, one where the slightest miscalculation can sink your mining operation before it even sets sail.

At the heart of this equation lies the mining rig itself. These specialized machines, purpose-built for cracking cryptographic puzzles, are the engines of the Bitcoin network. But not all rigs are created equal. The market is flooded with options, each boasting different hash rates (the speed at which they can solve these puzzles) and, crucially, different energy consumption levels. Choosing the right rig is paramount to profitability. Ignoring energy efficiency is akin to pouring money directly into the furnace; the higher the consumption, the lower your returns, especially when energy prices fluctuate.

Energy efficiency is no longer a desirable feature; it’s a necessity. The best Bitcoin mining rigs on the market today prioritize watts per terahash (W/TH). This metric directly reflects how much energy is required to perform a specific amount of mining work. Lower W/TH translates to higher efficiency, meaning more Bitcoin mined for the same energy input. Look for rigs that boast exceptionally low W/TH ratios – these are the champions of profitability in today’s competitive mining environment.

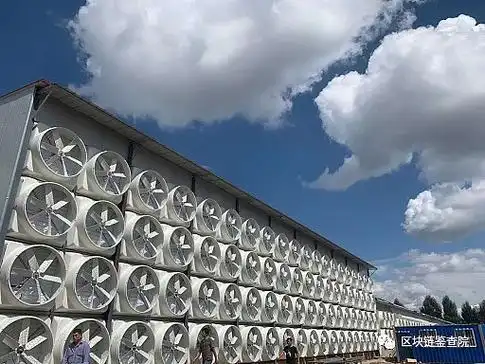

Beyond the rig itself, the location of your mining operation plays a crucial role. Hosting mining machines in regions with low electricity costs can dramatically improve profitability. This is where mining machine hosting services come into play. These services provide the infrastructure – the power, the cooling, the network connectivity – necessary to run mining rigs efficiently. They often have access to economies of scale that individual miners can’t achieve, negotiating lower electricity rates and implementing advanced cooling solutions to minimize energy waste.

But electricity costs are just one piece of the puzzle. The Bitcoin network itself introduces another layer of complexity: the difficulty adjustment. As more miners join the network, the difficulty of solving cryptographic puzzles increases. This ensures that the rate at which new Bitcoin are mined remains relatively constant. As difficulty increases, so does the computing power required to remain competitive. This underscores the importance of staying ahead of the curve, constantly evaluating and upgrading your hardware to maintain a profitable mining operation. Ignoring network difficulty is like trying to row a boat upstream in a raging current; you’ll expend a lot of effort without making much progress.

Beyond Bitcoin, the world of cryptocurrencies is a vast and diverse ecosystem. While Bitcoin remains the king, other cryptocurrencies, such as Ethereum (ETH) and Dogecoin (DOGE), also offer mining opportunities. However, the mining algorithms and hardware requirements for these cryptocurrencies differ significantly from Bitcoin. Ethereum, for example, has transitioned to a Proof-of-Stake (PoS) consensus mechanism, rendering traditional mining rigs obsolete. Dogecoin, on the other hand, relies on a different mining algorithm (Scrypt) that requires specialized hardware. Diversifying your mining portfolio can mitigate risk and potentially increase profitability, but it’s essential to understand the nuances of each cryptocurrency’s mining ecosystem.

Exchanges are the lifeblood of the cryptocurrency market. They provide the platform for buying, selling, and trading various cryptocurrencies. Understanding how exchanges work is crucial for maximizing the returns from your mining operation. By strategically timing your sales and taking advantage of market fluctuations, you can significantly increase your profits. However, it’s also important to be aware of the risks associated with exchanges, such as security breaches and regulatory uncertainty.

The cryptocurrency landscape is constantly evolving. New technologies, new regulations, and new market trends are emerging all the time. Staying informed is crucial for navigating this complex and dynamic environment. Follow industry news, attend conferences, and engage with the online community to stay ahead of the curve. Knowledge is power, and in the world of Bitcoin mining, it’s the key to unlocking sustainable profitability.

Finally, remember that Bitcoin mining is not a get-rich-quick scheme. It requires significant investment, technical expertise, and ongoing effort. But for those who are willing to put in the work, it can be a rewarding and profitable venture. By choosing energy-efficient rigs, leveraging mining machine hosting services, staying informed about the latest trends, and understanding the nuances of the cryptocurrency market, you can increase your chances of success in the exciting world of Bitcoin mining.

Leave a Reply